26 June 2006

The Drains Don't Work

(With apologies to The Verve)

It rained today - quite heavily. A couple more to follow for the hell of it.

FT's Lex on Andarko's Acquistions

“At the heart of this double deal is a striking disconnect between how the equity markets are valuing oil and natural gas reserves and how companies are valuing them. The companies can argue that the commodity markets are on their side, by pointing to strong futures prices for both oil and natural gas. Anadarko shows how this divergence can be put to use. It is hedging 75 per cent of the production it is acquiring, thereby locking in those advantageous prices. True, that still leaves more than half of the combined production unhedged, but it should help soothe nerves by removing a chunk of the financial risk.”

[composed and posted with ecto]

22 June 2006

Gas Wars

Gazprom risks dose of own medicine in Turkmen dispute - Energy Business Review:

Also here from Vedomosti and here from the Moscow Times.

I had not expected this to come to a head quite as quickly as this year. In short, Turkmenistan has woken up to the fact that Russia is selling its gas to to Ukraine at $230Mm3 whilst Turkmenistan is getting $65Mm3. In addition somewhere (you'll understand why the link is missing) is reporting that GAZP is buying substantially all of Turkmenistan's non-Ukrainian-bound production to meet Russian domestic demand. Better buy Turkmen gas at $50-65Mm3 than sell your own at that price.

Meanwhile RAO UES is reporting that there is not enough domestic gas (scraped off the MT website, thankfully translated from yesterdays Vedomosti. - copied at the bottom of the page.) Whilst any intra-Russian report of this kind has to be treated with skepticism, as its likely to be about something else altogether, the underlying facts are, in the short-term at least, correct. Is it interesting that Chubais goes public just before the Turkmen story breaks?

In the interest of completeness Jerome a Paris, one of the most authoritative sources on Russian/CIS/FSU gas, disagrees that there is a lack of gas which could be produced in an instant in Russia. He argues instead that GAZP is merely keeping its gas in the ground until the domestic price approaches netback parity. A good start for following his arguments is here. There are enough links to keep you going for a while. There are a number of people who disagree with him, including the IEA. Who in turn are under assault for made-up-numbers.

JaP also strongly believes that the proposed and announced gas pipeline between Kazakhstan and China, with a Turkmen branch, will never be built. I will agree that more pipelines are announced than built. In this case I will venture that Russia/GAZP has done enough to make the pipeline more rather than less likely. What will stop the pipeline is a change in the price that GAZP buys from Trashcanistan. Same result for our friend Turkmenbashi, oh great leader etc.

It seems likely that there will be a short and medium term solution to the Turkmen supply problem. In the short-term not much will change. The medium-term is more intriguing.

Here's the MT version of the Vedomosti article:

Unified Energy Systems doesn't have enough gas. Electricity consumption is rising, but no one is providing the electricity monopoly with any more gas. UES chief executive Anatoly Chubais said Tuesday that a 15 percent increase in the domestic price of gas in 2007 and the creation of a free internal gas market were the only way out of the impasse.

UES is the largest domestic purchaser of gas, accounting for about 30 percent of all domestic consumption, or 150 billion cubic meters of gas per year. Total production in Russia in 2005 was 641 billion cubic meters, 151 billion of which was exported. That UES is now facing a gas shortage is no surprise, as foreign demand for gas is rising. It is also rising on the domestic front, and the amount gas needed for electricity production will rise by more than 25 billion cubic meters by 2010. The supply to UES is slated to rise by only 3 billion. The amount of gas needed for electricity production will rise by about 15 percent until then, but Gazprom's development plans call for a production increase of only 8 percent by 2020.

That UES is already facing this kind of gas crunch today is the result of a number of factors, including rapid growth in electricity consumption and the fact that Gazprom is already channeling some production into reserves to cover increased winter demand. The differentiation between gas sold at federally fixed prices, from $46 to $48 per 1,000 cubic meters, and that sold at floating prices 15 to 25 percent higher is also an issue.

One solution would be for gas prices to rise, which would make it more attractive for Gazprom to sell to the domestic market and would remove the distinction between fixed and floating prices for gas. But raising domestic gas prices still won't address the main problem: Gazprom's own production shortfall. President Vladimir Putin recently commented that limited capacity at UES was acting as a significant brake on economic growth, identifying the cost at about 5 percent of gross domestic product. But regardless of capacity at UES, it can't produce electricity without gas.

There are three solutions: augment gas production, lower consumption or liberalize the gas market. The prospects on the consumption side are hardly better than those for production. Despite Chubais' statements that the share of gas in the production of electricity will fall slightly by 2010, the demand at UES will still rise in absolute terms. So liberalizing the gas market is the only practical option, and allowing independent producers access to the pipeline system is as important a step as raising domestic prices.

This comment was published as an editorial in Vedomosti.

[composed and posted with ecto]

Torture

“I have no answer to these questions, but I do know that if Vice President Cheney is right and that some ”cruel, inhumane or degrading“ (CID) treatment of captives is a necessary tool for winning the war on terrorism, then the war is lost already.”

[composed and posted with ecto]

21 June 2006

Statistics and Ideas

Two thoughts struck me as I waffled (which I do very convincingly):

How many truly entrepreneurial Russian companies are there across all sectors. The random list below is a start, please add if you think I have missed any.

I am not sure what the objective criteria for success are. Here are some random thoughts;

- I am going to create an arbitrary floor of a sale price or ongoing value of at least $100mn

- Any company built on the base of a privatized Soviet asset is disqualified.

- As is any business which built itself on government contracts - I think this disqualifies

- IBS,

- all system integrators

- outdoor advertising

- all natural resource companies (?),

- all real estate businesses (but not brokerages)

Here's the list:

- ABBYY

- STS/CTC Media

- TV3

- 36.6

- InterMark

- Kalina

- Pyatorchka (sp?)

- Sedmoi Kontinent

- Which Radio businesses?

- A4 Vision?

- SW Soft

- Yandex

- Ozon (does it qualify on the valuation front on a stand alone basis?)

- The two Nizhny Novogorod mobile outsourcers

- EPAM Systems

- Luxoft (but not IBS)

- actually more than I thought.

The second idea that struck me as I waffled was that in the technology / tech services sphere that a necessary (but not sufficient) criteria for success was; a Russian who had spent considerable time doing business outside Russia or a westerner who could act as an “translator” between western sales/management teams and Russian tech teams. Exceptions which prove the rule - SW Soft and ABBYY.

Your thoughts are requested.

[composed and posted with ecto]

Technorati Tags: entrepreneur, Russia

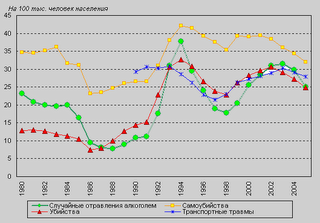

Curious statistics - Updated

On y'self Ecuador.

Delighted to see that less people are dying of “accidental alcohol poisoning” - that would be drinking themselves to death to you and I.

Slightly surprised to see that two other categories aren't included here;

- Died whilst ice fishing. Whilst this is mostly a subset of accidental alcohol poisoning there are plenty of other approaches to ending the misery.

- Died whilst enjoying the sun. Whilst the fundamental cause is just short of accidental alcohol poisoning actual death is more likely to be drowning due to accidental alcohol poisoning.

Curious statistics:

Causes of death per 100 thousand of population from 1980 till 2005.

Green – accidental alcohol poisoning

Red – homicides

Yellow – suicides

Blue – road accidents

[composed and posted with

ecto

]

Technorati Tags: death, Russia, statistics

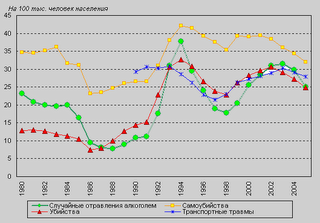

Curious statistics

Slightly surprised to see that two other categories aren't included here;

- Died whilst ice fishing. Whilst this is mostly a subset of accidental alcohol poisoning there are plenty of other approaches to ending the misery.

- Died whilst enjoying the sun. Whilst the fundamental cause is just short of accidental alcohol poisoning actual death is more likely to be drowning due to accidental alcohol poisoning.

Curious statistics:

Causes of death per 100 thousand of population from 1980 till 2005.

Green – accidental alcohol poisoning

Red – homicides

Yellow – suicides

Blue – road accidents

[composed and posted with ecto]

Technorati Tags: death, statistics, Russia

Private Equity and Shareholder Held Companies - Update

From the FT 21/06/06:

“José María Aristrain, a Spanish businessman who owns 3.7 per cent of Arcelor and has a representative on the board, called for the scrapping of a plan to merge the companies through the issue of new shares to Alexei Mordashov, a Russian steel tycoon.

He also called for the replacement of Arcelor’s two most senior executives. Mr Aristrain said Joseph Kinsch and Guy Dollé, chairman and chief executive, should ”come out“ of Arcelor on the grounds that they represented an ”old way“ of running public companies in which shareholders’ views were ignored.”

Summer has finally arrived in Moscow. You can tell because the mosquitos at the dacha are outsourcing themselves as back-up C130's, or more geographically correct, Antonov's. I love the long hours of daylight and the impact it has on my ability to think - the flip side of which is my inability to think during the long hours of darkness.

I read three significant articles/threads Saturday morning;

- On the Arcellor/Severstal/Mittal steel deal.

- On private equity's ability to generate superior returns to public markets

- On the significant undervaluation that public markets ascribed BAA compared with Ferrovial and Goldman Sachs.

With one or two honourable exceptions, Marks and Spencer leaps to mind, private equity has identified greater value than the public markets and worked harder to realize it. In some cases this has been as a result of short term financial engineering. In most cases, private equity shareholders have been genuinely involved in the business and have made management work for the benefit of shareholders (the people who actually own the business). By contrast shareholders of public businesses are only interested.

“A chicken and a pig were brainstorming...

Chicken:

Let's start a restaurant!

Pig:

What would we call it?

Chicken:

Ham n' Eggs!

Pig:

No thanks. I'd be committed, but you'd only be involved!”

Management of public businesses all to often work for their own benefit, or deride their shareholders ability to understand their businesses. As proof you could point to back-dated option scandal or, to my mind more important, the battle to get shareholder voted representatives on the boards of public companies.

There will always be exceptions that prove the rule. All too often the evidence points the other way. Arcellor's treatment of its shareholders being a case in point. Given that this is a blog about Russia I could happily point to any of the large listed Russian companies and make the same point.

What needs to be fixed here is not management but shareholders. And in Russia we should give up the pretense that we are shareholders and buy derivative instruments instead.

[composed and posted with

ecto

]

I am NOT Supporting England

It has been a good couple of weeks to be a not-an-english-supporter with the English rugby team coming third against the Aussies twice.

[composed and posted with ecto]

20 June 2006

Private Equity and Shareholder Held Companies

Summer has finally arrived in Moscow. You can tell because the mosquitos at the dacha are outsourcing themselves as back-up C130's, or more geographically correct, Antonov's. I love the long hours of daylight and the impact it has on my ability to think - the flip side of which is my inability to think during the long hours of darkness.

I read three significant articles/threads Saturday morning;

- On the Arcellor/Severstal/Mittal steel deal.

- On private equity's ability to generate superior returns to public markets

- On the significant undervaluation that public markets ascribed BAA compared with Ferrovial and Goldman Sachs.

With one or two honourable exceptions, Marks and Spencer leaps to mind, private equity has identified greater value than the public markets and worked harder to realize it. In some cases this has been as a result of short term financial engineering. In most cases, private equity shareholders have been genuinely involved in the business and have made management work for the benefit of shareholders (the people who actually own the business). By contrast shareholders of public businesses are only interested.

“A chicken and a pig were brainstorming...

Chicken:

Let's start a restaurant!

Pig:

What would we call it?

Chicken:

Ham n' Eggs!

Pig:

No thanks. I'd be committed, but you'd only be involved!”

Management of public businesses all to often work for their own benefit, or deride their shareholders ability to understand their businesses. As proof you could point to back-dated option scandal or, to my mind more important, the battle to get shareholder voted representatives on the boards of public companies.

There will always be exceptions that prove the rule. All too often the evidence points the other way. Arcellor's treatment of its shareholders being a case in point. Given that this is a blog about Russia I could happily point to any of the large listed Russian companies and make the same point.

What needs to be fixed here is not management but shareholders. And in Russia we should give up the pretense that we are shareholders and buy derivative instruments instead.

[composed and posted with ecto]

17 June 2006

Naive Comment of the Day - Rosneft Caveat Emptor

I want his job. He has never worked for a company that has not been majority owned by the state and he's worth a cool $700mn. That'll do it for me.

ВЕДОМОСТИ - Богданчиков купит “Роснефть” - Он готов вложить в акции компании треть своих сбережений:

Президент “Роснефти” Сергей Богданчиков хочет участвовать в IPO, чтобы стать совладельцем компании. “Да, я точно буду покупать акции ”Роснефти“, если совет директоров разрешит”, — рассказал он “Ведомостям”, добавив, что готов потратить на это примерно 30% всех сбережений. “Я рассматриваю это как долговременную инвестицию… Я не потрачу все деньги, но 30% — довольно много, если учесть, что у меня есть семья, сыновья”, — рассказывает Богданчиков. Оценить состояние Богданчикова сложно. Сам он об этом говорить не желает, а в списки богатейших людей, составленные журналами Forbes и “Финанс”, не входит. Польский журнал Wprost в 2005 г. приписывал ему $700 млн.

[composed and posted with ecto]

Technorati Tags: Corruption, IPO, Rosneft, Russia

Kazakhstan signs pipeline accord

Kazakhstan signs pipeline accord:

Kazakhstan moved to reduce its dependency on Russia signing a US-backed agreement to supply oil for a key Caspian-Mediterranean pipeline that will provide an alternative energy source for Europe.

[composed and posted with ecto]

Technorati Tags: Oil, Kazakhstan, pipeline, Russia

14 June 2006

Call a Spade a Spade

“Ethnic profiling by police officers on the city's metro system compromises crime-fighting and may point to corruption, a report released Tuesday by a liberal watchdog group states.”

[composed and posted with ecto]

Rosneft - Caveat Emptor

“This IPO smells bad,” said Agne Zitkute, fund manager at London-based Pictet Asset Management, which controls $12 billion of assets. “Frankly, I have a moral problem with buying back something that was stolen from me,” Zitkute said.

[composed and posted with ecto]

Reiman vs Alfa - A parallel game starts

My weekend email contained this gem of a RICO suit from IPOC against Alfa. It alleges that the stake in Megafon acquired by Alfa was illegally acquired from Rozhetskin and should instead have been delivered to IPOC. Not entirely unsurprisingly the suit fails to mention that IPOC is a vehicle which a Zurich tribunal has ruled contains the ill-gotten gains of the Minister of Communications (sic).

This is not the first time that a RICO suit has been used against Alfa to resolve a Russian business dispute. For those of you with memories of the Sidanco dispute between, (broadly) Potanin and Sputnik one one side and Alfa, Access Industries led TNK/BP on the other you will find various RICO suits which were subsequently dropped when the business dispute was settled. For truly salacious details you will have to find a way to deliver high quality bacon (the stuff from a pig, I just miss it) to my door on a regular basis.

This is the opening of a new front by IPOC who need to divert attention from the hammering they are taking on the original front. The press release is very short on specifics and long on blah (posted below for your edification) so I have no idea if it holds any water. Though I struggle with the concept that by buying the stake from Rozhetskin, that Alfa has been racketeering unless the original Option agreement was ruled to be in force - but as I am not a lawyer who knows.

“IPOC INTERNATIONAL GROWTH FUND LIMITED

Suite 1483

48 Par-la-Ville Road, Hamilton HM 11, Bermuda

P.O. Box HM 1737 Tel: (441) 295-9294

Hamilton HM GX Bermuda Fax: (441) 292 8899

FOR IMMEDIATE RELEASE Contact: Prism Public

Affairs

Dale Leibach

(202) 575-3800

RUSSIAN OLIGARCH FRIDMAN, CORPORATION SUED FOR

RACKETEERING, FRAUD THAT USED U.S. BANKS AND EXCHANGES

”Defendants’ Tentacles Reach Into and Injure Numerous

Americans“

NEW YORK – Russian corporation Alfa Group Consortium

and its U.S. entity, Alfa Capital Markets, Inc., are a

criminal enterprise that has used U.S. banks and stock

exchanges as an integral part of their theft schemes,

costing American taxpayers and stockholders hundreds

of millions of dollars, IPOC International Growth

Fund, Ltd., alleges in a federal racketeering lawsuit

filed late Thursday.

The suit alleges that Alfa, one of the largest

business conglomerates in the Russian Federation –

along with Russian oligarch Mikhail Fridman and U.S.

citizen Leonid Rozhetskin – engaged in a vast

international money laundering and fraud scheme in an

attempt to take control of the Russian cellular

industry. ”By doing so, defendants’ conduct has had a

substantial effect on the United States and its

citizens, and much of the criminal conduct occurred in

the United States,“ the suit, filed in U.S. District

Court for the Southern District of New York, said.

The criminal enterprise affected Americans, U.S.-based

investors and U.S. interests in numerous ways, the

complaint alleges, involving the evasion of U.S.

taxes, insider trading of shares on U.S. stock

markets, and wiring payments through New York banks.

The Alfa Group Consortium received support from the

Overseas Private Investment Corporation, a U.S.

government development agency, to provide a

significant portion of funding for one of Alfa’s

related businesses.

”The complaint alleges that the racketeering and other

wrongs cited in this case hurt U.S. investors, U.S.

taxpayers and U.S. financial markets,“ said W. Gordon

Dobie, an attorney with Winston & Strawn LLP, which

filed the case for IPOC International Growth Fund,

Ltd. ”It’s my opinion that the defendants should be

called to account in court for their conduct.“

A Daisy Chain of Nine Shell Companies

The suit details how Alfa, in a series of sham

transactions over a 10-day period, knowingly and

fraudulently colluded to steal IPOC’s 25.1 percent

stake in Russia’s third largest mobile telecom

company, MegaFon. IPOC had originally signed two

options agreements to buy the stake from LV Finance,

had paid for the shares and at all junctures honored

the terms of the agreements. At the final stage, IPOC

discovered that LV Finance, acting through its

chairman Leonid Rozhetskin, had negotiated a purported

sale of LV Finance’s interest in MegaFon to Mikhail

Fridman’s Alfa Group, involving a complex web of nine

offshore companies. Both companies are alleged to

have been aware of IPOC’s prior ownership rights, but

rode roughshod over the agreement and fraudulently

colluded to sell the same stake twice. They ”bought“

and ”sold“ the $50 million stake, and yet there is no

evidence of money having changed hands throughout this

daisy chain of sham transactions.

”What was a legitimate business opportunity for IPOC

evolved into a vehicle for Rozhetskin’s and Mikhail

Fridman’s theft and misappropriation,“ the suit

alleges.

Scheme Concealed Wrongdoing

The suit alleges that at the center of the enterprise

was Fridman, a major VimpelCom shareholder, who used

associates working directly for him and for VimpelCom,

to transfer the assets in the summer of 2003. The

scheme involved wiring payments through New York

banks, taking the proceeds, and then transferring

those proceeds to various off-shore companies ”to

conceal wrongdoing from IPOC, American taxing

authorities, and others.“

The suit states that Rozhetskin acted ”as a point

person to obtain additional cellular phone assets“ and

worked closely with Fridman to assist with the sham

transactions. He later relied on New York banks to

launder the theft of $50 million, the money IPOC paid

for the stake.

The complaint also alleges that Rozhetskin and Fridman

were assisted by Hans Bodmer, who served as escrow

agent and sent instructions to IPOC to wire money

through banks in New York for the benefit of the

defendants. Bodmer recently plead guilty to criminal

conspiracy to launder money and conspiracy to violate

the U.S. Foreign Corrupt Practices Act in connection

with an unrelated scheme to bribe foreign leaders.

Insider Dealing and Manipulation of VimpelCom Tax

Inquiry

The suit also alleges that Fridman and the Alfa Group

attempted to manipulate VimpelCom’s share price for

their own gain, in their position as major VimpelCom

shareholders. On Dec. 8, 2004, the suit said,

VimpelCom, a New York Stock Exchange Company,

disclosed the Russian tax authorities were

investigating the company for back taxes carrying

potential for heavy fines and penalties.

The news coincided with the auction of a $10 billion

subsidiary of Russian conglomerate Yukos to satisfy

back-dated tax obligations. Yukos later went through

an unprecedented bankruptcy filing in the United

States.

The suit claims that manipulation was insider dealing

that advanced the defendants’ goal of obtaining

control and consolidation of the telecommunications

market in Russia, furthering the ability to raise

prices for cellular services through a near-monopoly

or oligopoly.

Notes to Editors

• IPOC International Growth Fund, Ltd. is an

open-ended mutual fund company based in Bermuda.

• The suit, based on claims under the Racketeer

Influenced and Corrupt Organizations (RICO) Act,

charges that Fridman conspired with Rozhetskin to

steal IPOC’s interest through money laundering,

bribery, wire fraud and other criminal wrongdoings.

Other defendants are Alfa Capital Markets, Inc., a

U.S. corporation; Alfa Telecom (n/k/a) Altimo; and

Hans Bodmer.

• Alfa Group Consortium is an association of various

companies controlled by Fridman. It controls major

international corporations traded in the United

States, including VimpelCom (NYSE) Russia’s second

largest mobile telecoms company, Golden Telecom

(NASDAQ) and Turkcell (NYSE).

• For more information about IPOC, go to

www.ipocfund.com. A copy of the lawsuit is being

posted on this Web site June 9. ”

[composed and posted with ecto]

[composed and posted with ecto]

Technorati Tags: Reiman vs Alfa, Russia

Counter Productive Foreign & Gas Policy

As just about any oil & gas analyst worth his salt will tell you, and with special thanks to Stephen O'Sullivan of UFG, for the visuals, Russia's gas supply is not keeping up with demand. The very same slightly shady RosUkrenergo that was slated for the windfall profits it is earning for supplying Turkmen (primarily) gas to Ukraine, is actually petrified that it is locked in to below market supply arrangements that would leave it facing significant losses should Turkmen gas ever be sold at market prices (long sentence, sorry.)

Which has what to do with foreign policy? The story goes something like this. In the next 3-5 years or so the Kazakhs will have completed a gas pipeline to China which the Turkmens will also have access to. This is the swing production which GAZP uses to fulfill regulated domestic demand and below-market near-abroad (Ukraine) sales. If that 80BCM (bn cubic meters) per annum starts heading for China then both Ukraine and domestic Russia are going to have some pretty sharp and uncontrollable rises in domestic gas prices. That is not in GAZP's business plan which sees itself selling as much of its production as possible via its own transport systems and re-sellers to the nice Europeans who will pay $200/Mcm+ (thousand cubic meters) as opposed the great unwashed who currently pay a regulated price of $43Mcm and the near abroad who pay $90Mcm (blended price.)

Diverting exports because the locals are revolting just before an election would strike me as particularly unclever. So why force the Kazakhs, Turkmens and Uzbeks (collectively Trashcanistan) to eat shit and sell to GAZP at $50Mcm and then have the Chinese build them a big pipe so that the gas can be sold at a world market price.

Or does GAZP believe that it can bully China in to not building the pipeline by holding back on the E. Siberian pipeline - you know the one that they moved lake Baikal to avoid.

[composed and posted with ecto]

Technorati Tags: Gas, GAZP, Russia, Turkmenistan

10 June 2006

Why Startups Condense in America (and hence not in Russia)

I had promised that posting would be light - and it is. What's more it's likely to be whilst traveling, like now and therefore without significant links.

These two pieces; Why Startups Condense in America and How to be Silicon Valley by Paul Graham were the last two things that I through in to ecto to comment on. In the week that Oleg Koujikov, previously of ICap and IBS, announced that he was to head up Troika's venture fund, it seemed worthwhile to comment on them.

If you want the short version he's right. If it interests you read on.

Technology does not make a successful tech company, entrepreneurs make successful companies. Educational excellence (one the most popular misconceptions about Russia - that it has it that is) is a necessary but not sufficient condition. Entrepreneurs and environment are the key.

I could get in to a lot of trouble arguing that Russia lacks entrepreneurs. So I'll court the trouble and state based on my experience that in the technology sphere entrepreneurs are more represented by their absence than there presence. Which condition could be legitimately blamed on the environment or ecosystem.

Russia likes to compare itself with India and should be comparing itself with Israel; technologically that is. Some may say that Venezuela was more appropriate. Both are brim full of entrepreneurs with significant experience of doing business in the Silicon Valley.

I used to believe that the ecosystem was growing perceptibly. Today, my belief is that we are at least one and possibly 2 generations away from seeing a steady flow of Russian technology companies.

[composed and posted with ecto]

Technorati Tags: entrepreneur, Innovation, Russia, Technology

01 June 2006

Robbing Sam To Pay Ivan - Forbes.com - CTC Media IPO

Nowhere is it mentioned that many of those nasty sellers have been investors in the business for over 10 years having grown the business from scratch. Everyone has a right to sell.

The journalist will find when he comes to look, that the business was founded way back by Peter Gerwe, a US citizen, and substantially all of the early money raised was US money. Only later in its life did Alfa and MTG become shareholders.

The (libelous?) implication is that CTC stole its way to its leading independent position. Show how and where. It's very difficult to steal TV networks.

“Letting CTC Media's current shareholders indulge their fantasies of playing 19th-century robber barons is harmless--just don't contribute your money to the game.”As for his assertion that CTC has a sliver of the market; time to go (back) to business school - idiot.

I am not, have never been, a shareholder of CTC Media or Story First (it's predecessor) nor do I have will I make anything from its IPO.

Robbing Sam To Pay Ivan - Forbes.com:

[composed and posted with ecto]

Gazprom pushes for higher gas price from Belarus, rejects EU access claims - Energy Business Review

The article claims that GAZP push for higher prices is worrying because it is politically motivated.

Would it be OK if the price rises were economically motivated?

Is it OK to sell Belarus gas at $50/Mm3 which gives GAZP an effective net back rate of $20/Mm3 (albeit that it pays itself the transport tariff) when it could sell the same gas to Western Europe for $200/Mm3?

Why not call a spade a spade. In return for allowing Belarus to have below market gas it requires some other return. In this case its BelTransGas (Belarus Transit Gas Company - imaginative? They apparently paid millions for the branding :-)) that GAZP wants. Fair deal as far as I can see. Except that the mustache (Lukashenko) has never had to add up.

Gazprom pushes for higher gas price from Belarus, rejects EU access claims - Energy Business Review:

However relations between the satellite states and the Moscow-based monopoly have become strained amid accusations that some of the price increases are politically motivated.

[composed and posted with ecto]

26 June 2006

The Drains Don't Work

(With apologies to The Verve)

It rained today - quite heavily. A couple more to follow for the hell of it.

Posted by

The Ruminator

at

19:46

1 comments

![]()

FT's Lex on Andarko's Acquistions

“At the heart of this double deal is a striking disconnect between how the equity markets are valuing oil and natural gas reserves and how companies are valuing them. The companies can argue that the commodity markets are on their side, by pointing to strong futures prices for both oil and natural gas. Anadarko shows how this divergence can be put to use. It is hedging 75 per cent of the production it is acquiring, thereby locking in those advantageous prices. True, that still leaves more than half of the combined production unhedged, but it should help soothe nerves by removing a chunk of the financial risk.”

[composed and posted with ecto]

Posted by

The Ruminator

at

16:44

0

comments

![]()

22 June 2006

Gas Wars

I think that the Turkmenbashi, oh great leader of the people etc, is a Ruminations reader.

Gazprom risks dose of own medicine in Turkmen dispute - Energy Business Review:

Also here from Vedomosti and here from the Moscow Times.

I had not expected this to come to a head quite as quickly as this year. In short, Turkmenistan has woken up to the fact that Russia is selling its gas to to Ukraine at $230Mm3 whilst Turkmenistan is getting $65Mm3. In addition somewhere (you'll understand why the link is missing) is reporting that GAZP is buying substantially all of Turkmenistan's non-Ukrainian-bound production to meet Russian domestic demand. Better buy Turkmen gas at $50-65Mm3 than sell your own at that price.

Meanwhile RAO UES is reporting that there is not enough domestic gas (scraped off the MT website, thankfully translated from yesterdays Vedomosti. - copied at the bottom of the page.) Whilst any intra-Russian report of this kind has to be treated with skepticism, as its likely to be about something else altogether, the underlying facts are, in the short-term at least, correct. Is it interesting that Chubais goes public just before the Turkmen story breaks?

In the interest of completeness Jerome a Paris, one of the most authoritative sources on Russian/CIS/FSU gas, disagrees that there is a lack of gas which could be produced in an instant in Russia. He argues instead that GAZP is merely keeping its gas in the ground until the domestic price approaches netback parity. A good start for following his arguments is here. There are enough links to keep you going for a while. There are a number of people who disagree with him, including the IEA. Who in turn are under assault for made-up-numbers.

JaP also strongly believes that the proposed and announced gas pipeline between Kazakhstan and China, with a Turkmen branch, will never be built. I will agree that more pipelines are announced than built. In this case I will venture that Russia/GAZP has done enough to make the pipeline more rather than less likely. What will stop the pipeline is a change in the price that GAZP buys from Trashcanistan. Same result for our friend Turkmenbashi, oh great leader etc.

It seems likely that there will be a short and medium term solution to the Turkmen supply problem. In the short-term not much will change. The medium-term is more intriguing.

Here's the MT version of the Vedomosti article:

Unified Energy Systems doesn't have enough gas. Electricity consumption is rising, but no one is providing the electricity monopoly with any more gas. UES chief executive Anatoly Chubais said Tuesday that a 15 percent increase in the domestic price of gas in 2007 and the creation of a free internal gas market were the only way out of the impasse.

UES is the largest domestic purchaser of gas, accounting for about 30 percent of all domestic consumption, or 150 billion cubic meters of gas per year. Total production in Russia in 2005 was 641 billion cubic meters, 151 billion of which was exported. That UES is now facing a gas shortage is no surprise, as foreign demand for gas is rising. It is also rising on the domestic front, and the amount gas needed for electricity production will rise by more than 25 billion cubic meters by 2010. The supply to UES is slated to rise by only 3 billion. The amount of gas needed for electricity production will rise by about 15 percent until then, but Gazprom's development plans call for a production increase of only 8 percent by 2020.

That UES is already facing this kind of gas crunch today is the result of a number of factors, including rapid growth in electricity consumption and the fact that Gazprom is already channeling some production into reserves to cover increased winter demand. The differentiation between gas sold at federally fixed prices, from $46 to $48 per 1,000 cubic meters, and that sold at floating prices 15 to 25 percent higher is also an issue.

One solution would be for gas prices to rise, which would make it more attractive for Gazprom to sell to the domestic market and would remove the distinction between fixed and floating prices for gas. But raising domestic gas prices still won't address the main problem: Gazprom's own production shortfall. President Vladimir Putin recently commented that limited capacity at UES was acting as a significant brake on economic growth, identifying the cost at about 5 percent of gross domestic product. But regardless of capacity at UES, it can't produce electricity without gas.

There are three solutions: augment gas production, lower consumption or liberalize the gas market. The prospects on the consumption side are hardly better than those for production. Despite Chubais' statements that the share of gas in the production of electricity will fall slightly by 2010, the demand at UES will still rise in absolute terms. So liberalizing the gas market is the only practical option, and allowing independent producers access to the pipeline system is as important a step as raising domestic prices.

This comment was published as an editorial in Vedomosti.

[composed and posted with ecto]

Posted by

The Ruminator

at

09:30

0

comments

![]()

Torture

From the Washington Post:

“I have no answer to these questions, but I do know that if Vice President Cheney is right and that some ”cruel, inhumane or degrading“ (CID) treatment of captives is a necessary tool for winning the war on terrorism, then the war is lost already.”

[composed and posted with ecto]

Posted by

The Ruminator

at

08:58

0

comments

![]()

21 June 2006

Statistics and Ideas

I was interviewed as part of an EU project on commercializing Russian technology. It gave me an hour to listen to my own voice - one of my favourite sounds.

Two thoughts struck me as I waffled (which I do very convincingly):

How many truly entrepreneurial Russian companies are there across all sectors. The random list below is a start, please add if you think I have missed any.

I am not sure what the objective criteria for success are. Here are some random thoughts;

- I am going to create an arbitrary floor of a sale price or ongoing value of at least $100mn

- Any company built on the base of a privatized Soviet asset is disqualified.

- As is any business which built itself on government contracts - I think this disqualifies

- IBS,

- all system integrators

- outdoor advertising

- all natural resource companies (?),

- all real estate businesses (but not brokerages)

Here's the list:

- ABBYY

- STS/CTC Media

- TV3

- 36.6

- InterMark

- Kalina

- Pyatorchka (sp?)

- Sedmoi Kontinent

- Which Radio businesses?

- A4 Vision?

- SW Soft

- Yandex

- Ozon (does it qualify on the valuation front on a stand alone basis?)

- The two Nizhny Novogorod mobile outsourcers

- EPAM Systems

- Luxoft (but not IBS)

- actually more than I thought.

The second idea that struck me as I waffled was that in the technology / tech services sphere that a necessary (but not sufficient) criteria for success was; a Russian who had spent considerable time doing business outside Russia or a westerner who could act as an “translator” between western sales/management teams and Russian tech teams. Exceptions which prove the rule - SW Soft and ABBYY.

Your thoughts are requested.

[composed and posted with ecto]

Technorati Tags: entrepreneur, Russia

Posted by

The Ruminator

at

21:59

1 comments

![]()

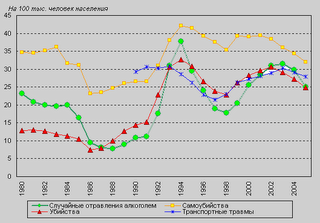

Curious statistics - Updated

Children, children. The only person who is allowed to be small-minded and petty on this blog is me.

On y'self Ecuador.

Delighted to see that less people are dying of “accidental alcohol poisoning” - that would be drinking themselves to death to you and I.

Slightly surprised to see that two other categories aren't included here;

- Died whilst ice fishing. Whilst this is mostly a subset of accidental alcohol poisoning there are plenty of other approaches to ending the misery.

- Died whilst enjoying the sun. Whilst the fundamental cause is just short of accidental alcohol poisoning actual death is more likely to be drowning due to accidental alcohol poisoning.

Curious statistics:

Causes of death per 100 thousand of population from 1980 till 2005.

Green – accidental alcohol poisoning

Red – homicides

Yellow – suicides

Blue – road accidents

[composed and posted with

ecto

]

Technorati Tags: death, Russia, statistics

Posted by

The Ruminator

at

21:32

0

comments

![]()

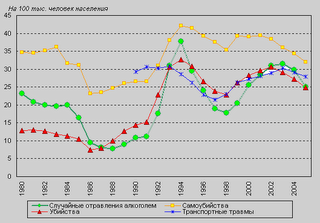

Curious statistics

Delighted to see that less people are dying of “accidental alcohol poisoning” - that would be drinking themselves to death to you and I.

Slightly surprised to see that two other categories aren't included here;

- Died whilst ice fishing. Whilst this is mostly a subset of accidental alcohol poisoning there are plenty of other approaches to ending the misery.

- Died whilst enjoying the sun. Whilst the fundamental cause is just short of accidental alcohol poisoning actual death is more likely to be drowning due to accidental alcohol poisoning.

Curious statistics:

Causes of death per 100 thousand of population from 1980 till 2005.

Green – accidental alcohol poisoning

Red – homicides

Yellow – suicides

Blue – road accidents

[composed and posted with ecto]

Technorati Tags: death, statistics, Russia

Posted by

The Ruminator

at

13:40

4

comments

![]()

Private Equity and Shareholder Held Companies - Update

From the FT 21/06/06:

“José María Aristrain, a Spanish businessman who owns 3.7 per cent of Arcelor and has a representative on the board, called for the scrapping of a plan to merge the companies through the issue of new shares to Alexei Mordashov, a Russian steel tycoon.

He also called for the replacement of Arcelor’s two most senior executives. Mr Aristrain said Joseph Kinsch and Guy Dollé, chairman and chief executive, should ”come out“ of Arcelor on the grounds that they represented an ”old way“ of running public companies in which shareholders’ views were ignored.”

Summer has finally arrived in Moscow. You can tell because the mosquitos at the dacha are outsourcing themselves as back-up C130's, or more geographically correct, Antonov's. I love the long hours of daylight and the impact it has on my ability to think - the flip side of which is my inability to think during the long hours of darkness.

I read three significant articles/threads Saturday morning;

- On the Arcellor/Severstal/Mittal steel deal.

- On private equity's ability to generate superior returns to public markets

- On the significant undervaluation that public markets ascribed BAA compared with Ferrovial and Goldman Sachs.

With one or two honourable exceptions, Marks and Spencer leaps to mind, private equity has identified greater value than the public markets and worked harder to realize it. In some cases this has been as a result of short term financial engineering. In most cases, private equity shareholders have been genuinely involved in the business and have made management work for the benefit of shareholders (the people who actually own the business). By contrast shareholders of public businesses are only interested.

“A chicken and a pig were brainstorming...

Chicken:

Let's start a restaurant!

Pig:

What would we call it?

Chicken:

Ham n' Eggs!

Pig:

No thanks. I'd be committed, but you'd only be involved!”

Management of public businesses all to often work for their own benefit, or deride their shareholders ability to understand their businesses. As proof you could point to back-dated option scandal or, to my mind more important, the battle to get shareholder voted representatives on the boards of public companies.

There will always be exceptions that prove the rule. All too often the evidence points the other way. Arcellor's treatment of its shareholders being a case in point. Given that this is a blog about Russia I could happily point to any of the large listed Russian companies and make the same point.

What needs to be fixed here is not management but shareholders. And in Russia we should give up the pretense that we are shareholders and buy derivative instruments instead.

[composed and posted with

ecto

]

Posted by

The Ruminator

at

09:55

0

comments

![]()

I am NOT Supporting England

The joy of being Scottish is that you can support everyone but England. The Swedes let me down last night with their inability to finish the English off. However, I feel that an ignominious loss to Ecuador is awaiting celebration on Sunday evening.

It has been a good couple of weeks to be a not-an-english-supporter with the English rugby team coming third against the Aussies twice.

[composed and posted with ecto]

Posted by

The Ruminator

at

08:27

0

comments

![]()

20 June 2006

Private Equity and Shareholder Held Companies

Summer has finally arrived in Moscow. You can tell because the mosquitos at the dacha are outsourcing themselves as back-up C130's, or more geographically correct, Antonov's. I love the long hours of daylight and the impact it has on my ability to think - the flip side of which is my inability to think during the long hours of darkness.

I read three significant articles/threads Saturday morning;

- On the Arcellor/Severstal/Mittal steel deal.

- On private equity's ability to generate superior returns to public markets

- On the significant undervaluation that public markets ascribed BAA compared with Ferrovial and Goldman Sachs.

With one or two honourable exceptions, Marks and Spencer leaps to mind, private equity has identified greater value than the public markets and worked harder to realize it. In some cases this has been as a result of short term financial engineering. In most cases, private equity shareholders have been genuinely involved in the business and have made management work for the benefit of shareholders (the people who actually own the business). By contrast shareholders of public businesses are only interested.

“A chicken and a pig were brainstorming...

Chicken:

Let's start a restaurant!

Pig:

What would we call it?

Chicken:

Ham n' Eggs!

Pig:

No thanks. I'd be committed, but you'd only be involved!”

Management of public businesses all to often work for their own benefit, or deride their shareholders ability to understand their businesses. As proof you could point to back-dated option scandal or, to my mind more important, the battle to get shareholder voted representatives on the boards of public companies.

There will always be exceptions that prove the rule. All too often the evidence points the other way. Arcellor's treatment of its shareholders being a case in point. Given that this is a blog about Russia I could happily point to any of the large listed Russian companies and make the same point.

What needs to be fixed here is not management but shareholders. And in Russia we should give up the pretense that we are shareholders and buy derivative instruments instead.

[composed and posted with ecto]

Posted by

The Ruminator

at

11:34

0

comments

![]()

17 June 2006

Naive Comment of the Day - Rosneft Caveat Emptor

Vedomosti reports that Bogdanchikov will invest up to 30% of his savings in the Rosneft IPO. The Polish magazine Wprost reports (it's a Wilipedia link - you think that I read Polish?) that his net worth is $700mn - so that would be a cool $233mn.

I want his job. He has never worked for a company that has not been majority owned by the state and he's worth a cool $700mn. That'll do it for me.

ВЕДОМОСТИ - Богданчиков купит “Роснефть” - Он готов вложить в акции компании треть своих сбережений:

Президент “Роснефти” Сергей Богданчиков хочет участвовать в IPO, чтобы стать совладельцем компании. “Да, я точно буду покупать акции ”Роснефти“, если совет директоров разрешит”, — рассказал он “Ведомостям”, добавив, что готов потратить на это примерно 30% всех сбережений. “Я рассматриваю это как долговременную инвестицию… Я не потрачу все деньги, но 30% — довольно много, если учесть, что у меня есть семья, сыновья”, — рассказывает Богданчиков. Оценить состояние Богданчикова сложно. Сам он об этом говорить не желает, а в списки богатейших людей, составленные журналами Forbes и “Финанс”, не входит. Польский журнал Wprost в 2005 г. приписывал ему $700 млн.

[composed and posted with ecto]

Technorati Tags: Corruption, IPO, Rosneft, Russia

Posted by

The Ruminator

at

09:38

0

comments

![]()

Kazakhstan signs pipeline accord

This one is expected to cut across the Caspian and then join up with or parallel the BP-led (or should that be US government led?) Baku-Ceyhan pipeline. Which passes through what the US like to call the “Freedom Corridor;” north of Iran and south of Russia. Absurd and ridiculous.

Kazakhstan signs pipeline accord:

Kazakhstan moved to reduce its dependency on Russia signing a US-backed agreement to supply oil for a key Caspian-Mediterranean pipeline that will provide an alternative energy source for Europe.

[composed and posted with ecto]

Technorati Tags: Oil, Kazakhstan, pipeline, Russia

Posted by

The Ruminator

at

09:07

0

comments

![]()

14 June 2006

Call a Spade a Spade

In anyone's language this is called Racism.

“Ethnic profiling by police officers on the city's metro system compromises crime-fighting and may point to corruption, a report released Tuesday by a liberal watchdog group states.”

[composed and posted with ecto]

Posted by

The Ruminator

at

09:02

2

comments

![]()

Rosneft - Caveat Emptor

“This IPO smells bad,” said Agne Zitkute, fund manager at London-based Pictet Asset Management, which controls $12 billion of assets. “Frankly, I have a moral problem with buying back something that was stolen from me,” Zitkute said.

[composed and posted with ecto]

Posted by

The Ruminator

at

08:58

1 comments

![]()

Reiman vs Alfa - A parallel game starts

My weekend email contained this gem of a RICO suit from IPOC against Alfa. It alleges that the stake in Megafon acquired by Alfa was illegally acquired from Rozhetskin and should instead have been delivered to IPOC. Not entirely unsurprisingly the suit fails to mention that IPOC is a vehicle which a Zurich tribunal has ruled contains the ill-gotten gains of the Minister of Communications (sic).

This is not the first time that a RICO suit has been used against Alfa to resolve a Russian business dispute. For those of you with memories of the Sidanco dispute between, (broadly) Potanin and Sputnik one one side and Alfa, Access Industries led TNK/BP on the other you will find various RICO suits which were subsequently dropped when the business dispute was settled. For truly salacious details you will have to find a way to deliver high quality bacon (the stuff from a pig, I just miss it) to my door on a regular basis.

This is the opening of a new front by IPOC who need to divert attention from the hammering they are taking on the original front. The press release is very short on specifics and long on blah (posted below for your edification) so I have no idea if it holds any water. Though I struggle with the concept that by buying the stake from Rozhetskin, that Alfa has been racketeering unless the original Option agreement was ruled to be in force - but as I am not a lawyer who knows.

“IPOC INTERNATIONAL GROWTH FUND LIMITED

Suite 1483

48 Par-la-Ville Road, Hamilton HM 11, Bermuda

P.O. Box HM 1737 Tel: (441) 295-9294

Hamilton HM GX Bermuda Fax: (441) 292 8899

FOR IMMEDIATE RELEASE Contact: Prism Public

Affairs

Dale Leibach

(202) 575-3800

RUSSIAN OLIGARCH FRIDMAN, CORPORATION SUED FOR

RACKETEERING, FRAUD THAT USED U.S. BANKS AND EXCHANGES

”Defendants’ Tentacles Reach Into and Injure Numerous

Americans“

NEW YORK – Russian corporation Alfa Group Consortium

and its U.S. entity, Alfa Capital Markets, Inc., are a

criminal enterprise that has used U.S. banks and stock

exchanges as an integral part of their theft schemes,

costing American taxpayers and stockholders hundreds

of millions of dollars, IPOC International Growth

Fund, Ltd., alleges in a federal racketeering lawsuit

filed late Thursday.

The suit alleges that Alfa, one of the largest

business conglomerates in the Russian Federation –

along with Russian oligarch Mikhail Fridman and U.S.

citizen Leonid Rozhetskin – engaged in a vast

international money laundering and fraud scheme in an

attempt to take control of the Russian cellular

industry. ”By doing so, defendants’ conduct has had a

substantial effect on the United States and its

citizens, and much of the criminal conduct occurred in

the United States,“ the suit, filed in U.S. District

Court for the Southern District of New York, said.

The criminal enterprise affected Americans, U.S.-based

investors and U.S. interests in numerous ways, the

complaint alleges, involving the evasion of U.S.

taxes, insider trading of shares on U.S. stock

markets, and wiring payments through New York banks.

The Alfa Group Consortium received support from the

Overseas Private Investment Corporation, a U.S.

government development agency, to provide a

significant portion of funding for one of Alfa’s

related businesses.

”The complaint alleges that the racketeering and other

wrongs cited in this case hurt U.S. investors, U.S.

taxpayers and U.S. financial markets,“ said W. Gordon

Dobie, an attorney with Winston & Strawn LLP, which

filed the case for IPOC International Growth Fund,

Ltd. ”It’s my opinion that the defendants should be

called to account in court for their conduct.“

A Daisy Chain of Nine Shell Companies

The suit details how Alfa, in a series of sham

transactions over a 10-day period, knowingly and

fraudulently colluded to steal IPOC’s 25.1 percent

stake in Russia’s third largest mobile telecom

company, MegaFon. IPOC had originally signed two

options agreements to buy the stake from LV Finance,

had paid for the shares and at all junctures honored

the terms of the agreements. At the final stage, IPOC

discovered that LV Finance, acting through its

chairman Leonid Rozhetskin, had negotiated a purported

sale of LV Finance’s interest in MegaFon to Mikhail

Fridman’s Alfa Group, involving a complex web of nine

offshore companies. Both companies are alleged to

have been aware of IPOC’s prior ownership rights, but

rode roughshod over the agreement and fraudulently

colluded to sell the same stake twice. They ”bought“

and ”sold“ the $50 million stake, and yet there is no

evidence of money having changed hands throughout this

daisy chain of sham transactions.

”What was a legitimate business opportunity for IPOC

evolved into a vehicle for Rozhetskin’s and Mikhail

Fridman’s theft and misappropriation,“ the suit

alleges.

Scheme Concealed Wrongdoing

The suit alleges that at the center of the enterprise

was Fridman, a major VimpelCom shareholder, who used

associates working directly for him and for VimpelCom,

to transfer the assets in the summer of 2003. The

scheme involved wiring payments through New York

banks, taking the proceeds, and then transferring

those proceeds to various off-shore companies ”to

conceal wrongdoing from IPOC, American taxing

authorities, and others.“

The suit states that Rozhetskin acted ”as a point

person to obtain additional cellular phone assets“ and

worked closely with Fridman to assist with the sham

transactions. He later relied on New York banks to

launder the theft of $50 million, the money IPOC paid

for the stake.

The complaint also alleges that Rozhetskin and Fridman

were assisted by Hans Bodmer, who served as escrow

agent and sent instructions to IPOC to wire money

through banks in New York for the benefit of the

defendants. Bodmer recently plead guilty to criminal

conspiracy to launder money and conspiracy to violate

the U.S. Foreign Corrupt Practices Act in connection

with an unrelated scheme to bribe foreign leaders.

Insider Dealing and Manipulation of VimpelCom Tax

Inquiry

The suit also alleges that Fridman and the Alfa Group

attempted to manipulate VimpelCom’s share price for

their own gain, in their position as major VimpelCom

shareholders. On Dec. 8, 2004, the suit said,

VimpelCom, a New York Stock Exchange Company,

disclosed the Russian tax authorities were

investigating the company for back taxes carrying

potential for heavy fines and penalties.

The news coincided with the auction of a $10 billion

subsidiary of Russian conglomerate Yukos to satisfy

back-dated tax obligations. Yukos later went through

an unprecedented bankruptcy filing in the United

States.

The suit claims that manipulation was insider dealing

that advanced the defendants’ goal of obtaining

control and consolidation of the telecommunications

market in Russia, furthering the ability to raise

prices for cellular services through a near-monopoly

or oligopoly.

Notes to Editors

• IPOC International Growth Fund, Ltd. is an

open-ended mutual fund company based in Bermuda.

• The suit, based on claims under the Racketeer

Influenced and Corrupt Organizations (RICO) Act,

charges that Fridman conspired with Rozhetskin to

steal IPOC’s interest through money laundering,

bribery, wire fraud and other criminal wrongdoings.

Other defendants are Alfa Capital Markets, Inc., a

U.S. corporation; Alfa Telecom (n/k/a) Altimo; and

Hans Bodmer.

• Alfa Group Consortium is an association of various

companies controlled by Fridman. It controls major

international corporations traded in the United

States, including VimpelCom (NYSE) Russia’s second

largest mobile telecoms company, Golden Telecom

(NASDAQ) and Turkcell (NYSE).

• For more information about IPOC, go to

www.ipocfund.com. A copy of the lawsuit is being

posted on this Web site June 9. ”

[composed and posted with ecto]

[composed and posted with ecto]

Technorati Tags: Reiman vs Alfa, Russia

Posted by

The Ruminator

at

08:07

0

comments

![]()

Counter Productive Foreign & Gas Policy

As just about any oil & gas analyst worth his salt will tell you, and with special thanks to Stephen O'Sullivan of UFG, for the visuals, Russia's gas supply is not keeping up with demand. The very same slightly shady RosUkrenergo that was slated for the windfall profits it is earning for supplying Turkmen (primarily) gas to Ukraine, is actually petrified that it is locked in to below market supply arrangements that would leave it facing significant losses should Turkmen gas ever be sold at market prices (long sentence, sorry.)

Which has what to do with foreign policy? The story goes something like this. In the next 3-5 years or so the Kazakhs will have completed a gas pipeline to China which the Turkmens will also have access to. This is the swing production which GAZP uses to fulfill regulated domestic demand and below-market near-abroad (Ukraine) sales. If that 80BCM (bn cubic meters) per annum starts heading for China then both Ukraine and domestic Russia are going to have some pretty sharp and uncontrollable rises in domestic gas prices. That is not in GAZP's business plan which sees itself selling as much of its production as possible via its own transport systems and re-sellers to the nice Europeans who will pay $200/Mcm+ (thousand cubic meters) as opposed the great unwashed who currently pay a regulated price of $43Mcm and the near abroad who pay $90Mcm (blended price.)

Diverting exports because the locals are revolting just before an election would strike me as particularly unclever. So why force the Kazakhs, Turkmens and Uzbeks (collectively Trashcanistan) to eat shit and sell to GAZP at $50Mcm and then have the Chinese build them a big pipe so that the gas can be sold at a world market price.

Or does GAZP believe that it can bully China in to not building the pipeline by holding back on the E. Siberian pipeline - you know the one that they moved lake Baikal to avoid.

[composed and posted with ecto]

Technorati Tags: Gas, GAZP, Russia, Turkmenistan

Posted by

The Ruminator

at

08:06

0

comments

![]()

10 June 2006

Why Startups Condense in America (and hence not in Russia)

I had promised that posting would be light - and it is. What's more it's likely to be whilst traveling, like now and therefore without significant links.

These two pieces; Why Startups Condense in America and How to be Silicon Valley by Paul Graham were the last two things that I through in to ecto to comment on. In the week that Oleg Koujikov, previously of ICap and IBS, announced that he was to head up Troika's venture fund, it seemed worthwhile to comment on them.

If you want the short version he's right. If it interests you read on.

Technology does not make a successful tech company, entrepreneurs make successful companies. Educational excellence (one the most popular misconceptions about Russia - that it has it that is) is a necessary but not sufficient condition. Entrepreneurs and environment are the key.

I could get in to a lot of trouble arguing that Russia lacks entrepreneurs. So I'll court the trouble and state based on my experience that in the technology sphere entrepreneurs are more represented by their absence than there presence. Which condition could be legitimately blamed on the environment or ecosystem.

Russia likes to compare itself with India and should be comparing itself with Israel; technologically that is. Some may say that Venezuela was more appropriate. Both are brim full of entrepreneurs with significant experience of doing business in the Silicon Valley.

I used to believe that the ecosystem was growing perceptibly. Today, my belief is that we are at least one and possibly 2 generations away from seeing a steady flow of Russian technology companies.

[composed and posted with ecto]

Technorati Tags: entrepreneur, Innovation, Russia, Technology

Posted by

The Ruminator

at

00:19

1 comments

![]()

01 June 2006

Robbing Sam To Pay Ivan - Forbes.com - CTC Media IPO

This is uninformed bullshit of the worst kind. If the journalist had bothered to look at the shareholder register of selling shareholders he would have found one Russian (sic Ivan) seller, with the remainder being US citizens or those nasty European types.

Nowhere is it mentioned that many of those nasty sellers have been investors in the business for over 10 years having grown the business from scratch. Everyone has a right to sell.

The journalist will find when he comes to look, that the business was founded way back by Peter Gerwe, a US citizen, and substantially all of the early money raised was US money. Only later in its life did Alfa and MTG become shareholders.

The (libelous?) implication is that CTC stole its way to its leading independent position. Show how and where. It's very difficult to steal TV networks.

“Letting CTC Media's current shareholders indulge their fantasies of playing 19th-century robber barons is harmless--just don't contribute your money to the game.”As for his assertion that CTC has a sliver of the market; time to go (back) to business school - idiot.

I am not, have never been, a shareholder of CTC Media or Story First (it's predecessor) nor do I have will I make anything from its IPO.

Robbing Sam To Pay Ivan - Forbes.com:

[composed and posted with ecto]

Posted by

The Ruminator

at

12:33

0

comments

![]()

Gazprom pushes for higher gas price from Belarus, rejects EU access claims - Energy Business Review

The article claims that GAZP push for higher prices is worrying because it is politically motivated.

Would it be OK if the price rises were economically motivated?

Is it OK to sell Belarus gas at $50/Mm3 which gives GAZP an effective net back rate of $20/Mm3 (albeit that it pays itself the transport tariff) when it could sell the same gas to Western Europe for $200/Mm3?

Why not call a spade a spade. In return for allowing Belarus to have below market gas it requires some other return. In this case its BelTransGas (Belarus Transit Gas Company - imaginative? They apparently paid millions for the branding :-)) that GAZP wants. Fair deal as far as I can see. Except that the mustache (Lukashenko) has never had to add up.

Gazprom pushes for higher gas price from Belarus, rejects EU access claims - Energy Business Review:

However relations between the satellite states and the Moscow-based monopoly have become strained amid accusations that some of the price increases are politically motivated.

[composed and posted with ecto]

Posted by

The Ruminator

at

09:01

0

comments

![]()